Motorists in London are paying as much as 323 per cent extra for automotive insurance coverage than drivers in different components of the UK, stunning new analysis has discovered.

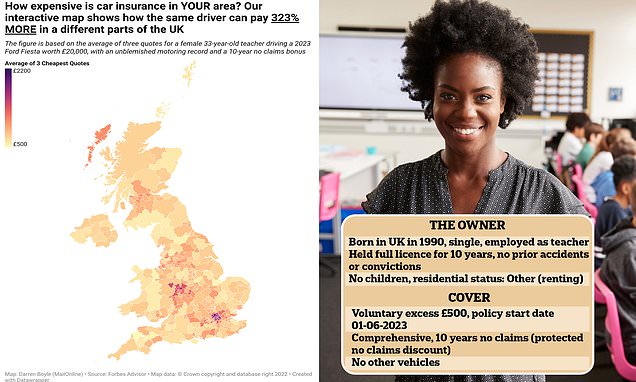

Utilizing the instance of a 33-year-old feminine instructor who has a clear driving licence and a 10-year no claims bonus, researchers seemed for the perfect quotes to cowl her £20,000, 23-plate Ford Fiesta in every native authority space throughout England, Wales, Scotland and Northern Eire.

Unsurprisingly, the insurance policies for dwelling in main city areas have been dearer.

The driving force searching for cowl for the automotive in Haringey was quoted £2,197.03.

If that very same instructor moved to Torridge, Devon, they’d pay £519.48 for precisely the identical cowl – inserting an enormous tax on motorists dwelling and dealing within the capital.

The analysis was launched as new knowledge exhibits that automotive insurance coverage claims jumped by a 3rd throughout the first three months of 2023.

Your browser doesn’t help iframes.

Your browser doesn’t help iframes.

The check profile was a 33-year-old feminine instructor with an unblemished 10-year driving report driving a small household automotive. Relying on the place she lived, the price of the insurance coverage might improve by greater than 320 per cent

In line with the Affiliation of British Insurers, 30 per cent of a automotive coverage’s price covers potential harm funds, with 20 per cent used to restore the motive force’s automobile. Harm to different autos and property accounts for an additional 19 per cent of the coverage’s price.

The insurance coverage firm will tackle common 17 per cent to cowl its overheads, whereas theft, alternative autos and uninsured drivers every account for a complete of 12 per cent of the citation. The ultimate 2 per cent of the insurance coverage coverage is used to pay windscreen claims.

The federal government then takes a 12 per cent insurance coverage premium tax, which disproportionately impacts these dwelling in larger danger areas.

In line with Howard Cox, FairFuel UK Founder and Reform UK’s candidate for Mayor of London, he’s being inundated by offended Londoners feeling the stress on their wallets.

He advised MailOnline and That is Cash: ‘There isn’t any justification to fleece high quality skilled drivers with a clear driving report by climbing insurance coverage premiums for merely dwelling in London.

‘Together with the grasping unchecked gas provide chain, drivers are seen by different massive enterprise as simple to rip-off money cows. As London Mayor I’ll maintain these insurance coverage tyrants to account and expose their dishonesty.’

Howard Cox, Reform UK’s candidate for Mayor of London mentioned he believes skilled London drivers are being ‘fleeced’ within the ongoing battle on motorists within the capital

The Affiliation of British Insurers have supplied a breakdown of the place the price of a automotive insurance coverage coverage goes

The analysis was carried out by Forbes Advisor, who checked the worth of insurance coverage throughout 3,102 totally different postcodes with a variety of suppliers utilizing a comparability web site.

If the 33-year-old instructor was dwelling and dealing in PM Rishi Sunak’s Richmond constituency, she might anticipate to pay £556.65.

But when she was dwelling close to 10 Downing Avenue, that very same automotive would price her £1,684 to insure for 12 months – a ‘capital tax’ of greater than £1,100.

That is sufficient to fill the gas tank of the automotive nearly 19 instances, and in keeping with Ford’s figures, needs to be sufficient to maintain her on the street for 10,000 miles.

CLICK TO READ MORE: Why did insurance coverage firm cost me £1,000 for a small scratch on a rent automotive? Automotive calamity: Our reader employed a automotive, and was later charged £982 for what he thought have been minor repairs (inventory picture, not the automotive in query)

Waltham Forest, which neighbours Haringey, would price £1,460 – which is £53 dearer than Telford and Wrekin – the worst insurance coverage spot outdoors the capital.

Kevin Pratt, automotive insurance coverage spokesperson at Forbes Advisor, mentioned: ‘It is attention-grabbing to see how a lot costs for automotive insurance coverage change all through the UK. If plotted on a map, the areas that occupy the highest 10 most cost-effective quotes checklist are broadly unfold throughout the nation.

‘However, all of the native authorities the place automotive insurance coverage is costliest are London boroughs, which underlines how costly it’s to reside within the capital.

‘Wherever you reside, if you happen to’re a driver, automotive insurance coverage is a authorized requirement. When contemplating your choices, it is vital to do not forget that the most cost effective premiums won’t present the extent of canopy that you just want.

‘There are different elements to contemplate past worth, corresponding to how an insurer treats its clients and handles claims. That is why it is at all times value taking the time to contemplate which suppliers will give you the perfect worth cowl.’

An ABI spokesperson advised MailOnline and That is Cash: ‘A buyer’s postcode is only one of many elements that an insurer will take into account when assessing danger.

‘It may well present a variety of details about the world from the density of site visitors and historical past of site visitors incidents to the automobile crime fee, alongside different particulars the insurer will have a look at corresponding to age, driving report, the kind of automotive and its intendeduse.

‘Our motor premium tracker, the one one primarily based on the precise worth paid by the shopper reasonably than quotes, exhibits the typical price of complete motor insurance coverage is at present £478. Motor insurance coverage is a aggressive market so it’s at all times value purchasing round to get the perfect deal in your wants.’

Nonetheless, customers have been warned that deferring funds by signing a credit score settlement with the insurer reasonably than paying in a single lump sum can price them as much as £300 further a 12 months.

Whereas those that have keyless automobiles and have their autos stolen face having their claims denied by their insurance coverage firm until they took further measures to stop excessive tech ‘relay theft’.

The Affiliation of British Insurers, which represents the trade mentioned its members paid out £2.4bn in motor claims between January 1 and March 31 this 12 months.

This, in keeping with the ABI was a 14 per cent improve on the identical quarter final 12 months. Private harm claims, corresponding to these for whiplash price £642million – a rise of two per cent over the identical interval in 2022.

The ABI mentioned whiplash reforms launched in 2021 could also be having a optimistic affect on controlling the price of harm claims related to street site visitors collisions.

Laura Hughes of the ABI mentioned: ‘Motor insurers proceed to ship when motorists and private harm claimants want them essentially the most.

‘Like most different enterprise sectors, motor insurers face sustained price pressures which they’re discovering more and more difficult to soak up. Regardless of this they’re doing all they will to make sure competitively priced motor insurance coverage, in addition to providing the very best claims service.’

Motorists in city areas face far larger insurance coverage quotations than these dwelling within the nation

In line with the ABI, the rising complexity of automobiles is making it dearer to restore autos, whereas longer restore instances and rising second hand prices are all placing stress on quotations.

Between January and March, some 599,000 motor insurance coverage claims have been settled, with a value of repairs of £1.5bn – a 33 per cent improve on 2022.

Worse nonetheless for hard-pressed motorists, funds for stolen automobiles have elevated by 29 per cent within the first three months of this 12 months to £152 million.

Earlier this week, insurance coverage trade representatives showing earlier than the Treasury Committee pushed again at perceptions that corporations are ‘profiteering’ throughout the cost-of-living disaster.

Worse nonetheless for hard-pressed motorists, funds for stolen automobiles have elevated by 29 per cent within the first three months of this 12 months to £152 million

Through the listening to, Charlotte Clark, director of regulation on the ABI highlighted ‘vital price pressures’ together with prices associated to automobiles.

Cristina Nestares, chief govt of Admiral UK, advised the listening to on Wednesday: ‘The common of if you pay the declare could possibly be two years.

‘First, as a result of the accident can occur within the subsequent 12 months, secondly as a result of when the declare is paid is determined by the complexity, if it is a injury declare, windscreen or possibly if it is a big bodily harm declare. So on common, it might take two years.’

She mentioned two years of inflation ‘is what you really want to use to each coverage. Really you see that we’re not profiteering.’

Latest figures from the ABI confirmed that motorists sometimes paid £478 for personal complete cowl within the first three months of 2023, which was a 16 per cent improve in contrast with the primary quarter of 2022 and the best determine recorded since premiums price £483 on common within the ultimate quarter of 2019.